Embarking on a journey to implement Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems is a significant strategic move for any organization, irrespective of its size or industry. These powerful software solutions promise to revolutionize operations, enhance customer engagement, and drive unprecedented efficiencies. However, the path to unlocking these benefits is often paved with substantial financial commitments. It’s not just about the sticker price of the software; rather, it’s about a complex web of direct and indirect costs that can easily spiral out of control if not meticulously planned. This article delves deep into the critical aspect of budgeting for ERP and CRM: a financial perspective, offering insights into how businesses can meticulously plan, allocate, and manage funds to ensure a successful and financially sound implementation. We’ll explore various cost components, strategic considerations, and best practices to help you navigate this complex financial landscape effectively. Understanding these nuances is paramount for securing executive buy-in and achieving a strong return on investment.

Unpacking the Core: What Are ERP and CRM Systems?

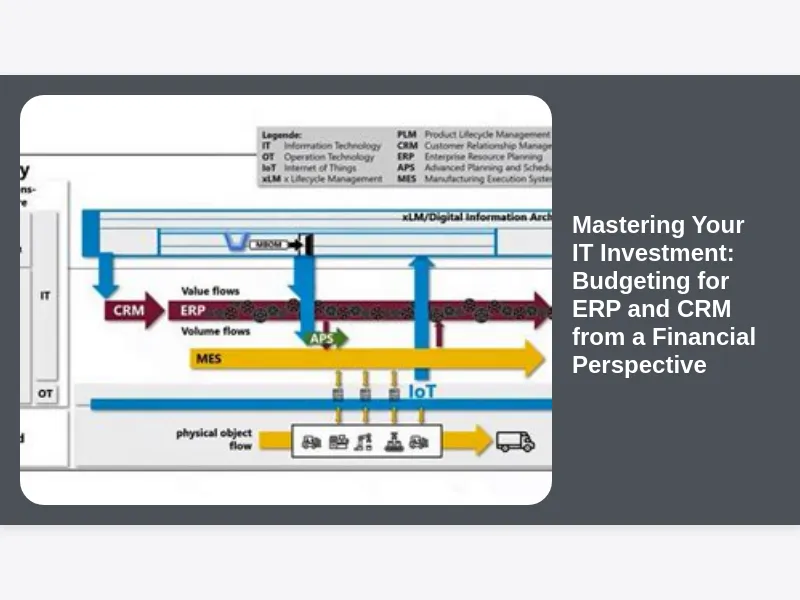

Before we dive into the intricacies of financial planning, it’s crucial to establish a clear understanding of what ERP and CRM systems entail. While often discussed together due to their complementary nature in enhancing business processes, they serve distinct primary functions. Enterprise Resource Planning (ERP) systems are integrated software solutions designed to manage and automate core business processes across an organization, including financials, human resources, manufacturing, supply chain, procurement, and more. Think of an ERP system as the central nervous system of your company, connecting disparate departments and providing a unified view of operations. Its goal is to streamline workflows, improve data accuracy, and foster collaboration, ultimately leading to greater operational efficiency and cost savings through optimization.

On the other hand, Customer Relationship Management (CRM) systems focus specifically on managing all interactions and relationships with customers and potential customers. A CRM helps organizations stay connected to customers, streamline processes, and improve profitability. This includes managing sales pipelines, marketing campaigns, customer service interactions, and providing analytical insights into customer behavior and preferences. While ERP looks inward at business processes, CRM looks outward at customer interactions, striving to enhance customer satisfaction, loyalty, and ultimately, sales. Budgeting for ERP and CRM effectively means understanding the distinct, yet often intertwined, value propositions of each system and planning for their respective, or combined, financial requirements. The strategic integration of both systems can unlock powerful synergies, but also introduce greater complexity in financial forecasting.

The Initial Investment: Licensing and Software Acquisition Costs

One of the most immediate and tangible components of budgeting for ERP and CRM is the cost associated with software licenses or subscriptions. This represents the fundamental permission to use the software. The pricing models can vary significantly depending on whether you opt for an on-premise solution or a cloud-based (SaaS – Software as a Service) offering. For on-premise deployments, you typically purchase perpetual licenses, which are a one-time upfront cost, often based on the number of users, modules, or processing capacity. These licenses grant you ownership of the software usage rights indefinitely, though ongoing maintenance contracts are usually required.

Conversely, cloud-based ERP and CRM solutions operate on a subscription model, where you pay a recurring fee, typically monthly or annually, per user or per module. While these recurring costs might seem lower initially compared to a large upfront license purchase, they accumulate over time and must be factored into your long-term financial projections. Organizations need to carefully compare the total cost of ownership (TCO) for both models over a 5-10 year period. Factors influencing these initial costs also include the vendor’s pricing structure, the specific features or modules required, and any customization needs identified during the initial scoping phase. This initial software acquisition phase is just the tip of the iceberg when considering the full financial commitment.

Beyond the Price Tag: Understanding Total Cost of Ownership (TCO)

The concept of Total Cost of Ownership (TCO) is absolutely vital when embarking on budgeting for ERP and CRM projects. Many organizations make the mistake of focusing solely on the software licensing fees, only to be blindsided by a cascade of additional expenses post-purchase. TCO encompasses not just the initial acquisition cost but also all direct and indirect costs associated with the entire lifecycle of the system, from implementation to ongoing maintenance, support, and eventual upgrades or replacements. Neglecting TCO can lead to significant budget overruns, project delays, and ultimately, a failure to realize the expected return on investment. It’s a comprehensive financial exercise that demands foresight and detailed planning.

Key components of TCO extend far beyond the software itself. They include hardware costs (for on-premise solutions), implementation services (consulting, configuration, development), data migration, user training, ongoing maintenance and support contracts, customization and integration expenses, internal staffing costs, and even potential opportunity costs from project delays. A holistic TCO analysis provides a realistic financial picture, allowing organizations to allocate funds accurately and prepare for all potential expenditures. Engaging with vendors early to obtain transparent TCO breakdowns, and conducting your own internal analysis, is critical for informed decision-making and preventing unwelcome financial surprises down the line.

Implementation Expenses: The Unseen Bulk of Your Investment

Often, the largest single component of the budget for an ERP or CRM project is the implementation phase. This isn’t merely about installing software; it’s about configuring, customizing, integrating, and deploying a complex system to meet the unique needs of your business processes. Implementation costs can easily outweigh the software licensing fees, sometimes by a factor of two or three. These expenses are primarily driven by the professional services required to get the system up and running efficiently. This includes the fees paid to external consultants, system integrators, and specialized technical experts who possess the knowledge and experience to tailor the software to your specific operational workflows.

The scope of implementation services can be broad, covering activities such as project management, business process analysis and re-engineering, system configuration, custom development for unique functionalities, data cleansing and migration from legacy systems, quality assurance and testing, and user acceptance testing. Each of these steps requires dedicated time and expertise, translating directly into significant labor costs. The complexity of your existing IT infrastructure, the volume and quality of your data, and the degree of customization required will all heavily influence the overall implementation expenditure. Thoroughly scoping these needs and getting detailed proposals from potential implementation partners is crucial for accurate budgeting for ERP and CRM projects, ensuring you account for this substantial financial outlay.

Data Migration: Cleaning, Moving, and Securing Your Information

One of the most critical, yet frequently underestimated, cost centers in an ERP or CRM implementation project is data migration. This involves the complex process of extracting data from existing legacy systems, cleansing it to ensure accuracy and consistency, transforming it into a format compatible with the new system, and finally loading it into the new ERP or CRM database. Poorly executed data migration can lead to significant operational disruptions, inaccurate reporting, and ultimately, a loss of trust in the new system. The financial implications stem from the sheer labor intensity and specialized skills required.

Data cleansing is often the most time-consuming and expensive part of this process. Businesses frequently accumulate years, even decades, of redundant, inaccurate, or incomplete data. Identifying and rectifying these issues before migration is paramount. This can involve significant internal resources dedicated to data validation or the hiring of external data specialists. Furthermore, the technical challenge of mapping old data structures to new ones, especially when dealing with highly customized legacy systems, can necessitate custom scripting and development work. Security during data transfer and storage is another non-negotiable aspect, potentially requiring additional tools or compliance measures. Neglecting a thorough data migration strategy and allocating sufficient budget for this phase is a common pitfall in budgeting for ERP and CRM, leading to frustrating and costly delays down the line.

User Training and Change Management: Investing in Your People

Even the most advanced ERP and CRM systems are only as effective as the people using them. Therefore, a significant portion of your budgeting for ERP and CRM must be allocated to user training and robust change management initiatives. The introduction of new systems often entails a fundamental shift in how employees perform their daily tasks, access information, and collaborate. Without adequate preparation and training, resistance to change can derail even the most well-planned implementation, negating the financial investment. This isn’t a one-time event; it’s an ongoing process of education and adaptation.

Training costs encompass developing customized training materials, hiring professional trainers (internal or external), providing access to e-learning platforms, and potentially covering travel and accommodation for employees attending off-site sessions. Beyond direct training, change management is about strategically guiding employees through the transition, addressing their concerns, building enthusiasm, and demonstrating the benefits of the new system. This can involve communication campaigns, workshops, dedicated support teams, and incentives. The financial perspective here is that inadequate investment in training and change management translates directly into lower user adoption rates, reduced productivity, increased error rates, and ultimately, a failure to fully capitalize on the system’s capabilities. It’s an investment in human capital that directly impacts the ROI of your technology.

Customization and Integration: Tailoring for Unique Business Needs

While off-the-shelf ERP and CRM solutions offer a broad range of functionalities, most businesses have unique processes or requirements that necessitate some degree of customization or integration with existing systems. This is a critical area for budgeting for ERP and CRM, as custom development work can be notoriously expensive and time-consuming. Customization involves modifying the core software code, adding new features, or altering user interfaces to fit specific business workflows. While this can make the system perfectly aligned with your operations, it also creates dependencies and can complicate future upgrades, potentially leading to higher ongoing maintenance costs.

Integration, on the other hand, involves connecting the new ERP or CRM system with other applications already in use within your organization, such as e-commerce platforms, marketing automation tools, legacy financial systems, or specialized industry-specific software. Seamless data flow between these systems is crucial for a unified view of business operations and customer interactions. Integration can be achieved through various methods, including API development, middleware solutions, or custom connectors, each carrying its own cost implications. Both customization and integration require highly skilled developers and architects, adding significant labor costs to the project. Organizations must carefully balance the benefits of bespoke solutions against their financial implications and the potential for increased complexity in future maintenance and upgrades.

Hardware and Infrastructure: The Foundation for On-Premise Systems

For organizations opting for an on-premise ERP or CRM deployment, significant budgeting for ERP and CRM must be allocated to the necessary hardware and IT infrastructure. Unlike cloud-based solutions where the vendor manages the underlying infrastructure, on-premise systems require substantial upfront capital expenditure for servers, networking equipment, data storage solutions, and robust backup and recovery systems. These components must be powerful enough to support the software’s demands, accommodate expected user loads, and ensure high availability and performance. The exact specifications will depend on the chosen software, the number of users, the volume of data, and the complexity of the transactions.

Beyond the initial purchase, there are ongoing costs associated with managing this infrastructure. These include power consumption, cooling systems to prevent overheating, physical security for data centers, and the salaries of IT personnel dedicated to monitoring, maintaining, and troubleshooting the hardware. Regular hardware upgrades or replacements will also be necessary to keep pace with technological advancements and software requirements. Furthermore, disaster recovery planning, including redundant hardware and off-site backups, adds another layer of financial commitment. While cloud solutions mitigate these hardware costs, the on-premise model shifts the responsibility and associated financial burden entirely to the implementing organization, requiring a comprehensive infrastructure budget.

Ongoing Maintenance, Support, and Upgrades

The financial commitment for ERP and CRM systems does not end once they are implemented. Ongoing maintenance, support, and periodic upgrades represent a continuous expenditure that must be meticulously planned for in your long-term budgeting for ERP and CRM. For on-premise solutions, this typically includes annual maintenance contracts with the software vendor, providing access to bug fixes, patches, and major version upgrades. These contracts are often a percentage of the initial software license cost, ranging from 15% to 25% annually. Additionally, internal IT staff or external consultants will be needed for routine system administration, performance monitoring, troubleshooting, and applying updates.

For cloud-based (SaaS) solutions, maintenance and basic upgrades are usually included in the recurring subscription fee. However, even with SaaS, organizations must budget for ongoing administrative tasks, user management, and potentially additional modules or feature sets as their business evolves. Furthermore, both deployment models may require ongoing investment in security patches, compliance updates, and potentially re-customization if core software upgrades overwrite previous modifications. Neglecting to budget adequately for these post-implementation costs can lead to system degradation, security vulnerabilities, lack of access to new features, and a decline in overall system performance and utility over time.

Staffing and Internal Resource Allocation: The Hidden Costs

When considering budgeting for ERP and CRM, many organizations primarily focus on external vendor costs. However, the allocation of internal resources and the associated staffing costs represent a significant, often underestimated, portion of the total investment. Implementing these complex systems is not a hands-off process; it requires dedicated involvement from various internal departments and individuals throughout the entire project lifecycle, from initial planning and requirements gathering to testing, training, and ongoing support.

Key internal roles include a dedicated project manager, subject matter experts from finance, HR, sales, marketing, and operations, IT specialists, and data analysts. These individuals will spend considerable time away from their regular duties, impacting their departmental productivity. Their salaries and benefits during their involvement in the project effectively become part of the ERP/CRM budget. For larger, more complex implementations, organizations might even need to hire new staff with specialized skills, such as business analysts, data architects, or dedicated system administrators, particularly for on-premise deployments. Factoring in the opportunity cost of reassigning high-value employees and the direct cost of internal staff hours is crucial for a realistic financial forecast. Overlooking these internal resource costs can lead to significant budget shortfalls and strain on existing teams.

Measuring Return on Investment (ROI): Justifying the Financial Outlay

While budgeting for ERP and CRM is about managing costs, the ultimate goal of such a significant investment is to achieve a positive return on investment (ROI). Justifying the substantial financial outlay requires a clear framework for measuring the tangible and intangible benefits derived from the new systems. Tangible benefits are quantifiable and directly measurable, such as reductions in operational costs (e.g., through process automation, reduced manual errors, inventory optimization), increased revenue (e.g., through improved sales efficiency, better customer retention), accelerated financial close processes, and improved supply chain efficiency. These can be translated into monetary savings or gains that directly impact the bottom line.

Intangible benefits, while harder to quantify in precise monetary terms, are equally important. These include improved decision-making capabilities due to better data visibility, enhanced customer satisfaction, increased employee productivity and morale, better compliance with regulations, and improved competitive advantage. While these don’t directly show up on a profit and loss statement, they contribute to the long-term health and growth of the organization. Developing clear ROI metrics and a baseline before implementation, then tracking these metrics rigorously post-implementation, is essential. A robust financial perspective on ERP and CRM isn’t just about spending money; it’s about making a strategic investment that yields measurable financial and operational improvements.

Risk Mitigation and Contingency Planning: Budgeting for the Unexpected

Even the most meticulously planned ERP and CRM projects can encounter unforeseen challenges. Therefore, an essential component of responsible budgeting for ERP and CRM is the allocation of funds for risk mitigation and contingency planning. Ignoring potential pitfalls or assuming a flawless implementation is a recipe for budget overruns and project delays. Risks can emerge from various sources, including unexpected technical complexities, scope creep (where project requirements expand beyond the initial plan), data quality issues, resistance to change from employees, vendor performance issues, or even external economic shifts.

A prudent financial strategy dictates setting aside a contingency fund, typically ranging from 10% to 25% of the total project budget, depending on the project’s complexity and the organization’s risk tolerance. This reserve acts as a buffer to absorb unexpected costs, allowing the project to stay on track without derailing the overall financial plan. Beyond just money, risk mitigation also involves developing proactive strategies to identify, assess, and address potential issues before they escalate. This could mean engaging with experienced consultants to identify common pitfalls, building in buffer time for critical tasks, or even having backup plans for key resources. A well-thought-out risk and contingency budget provides financial resilience and peace of mind, safeguarding your significant investment.

Phased Implementation: Spreading Out the Financial Burden

For many organizations, particularly larger enterprises or those with complex legacy systems, a “big bang” approach to ERP and CRM implementation – deploying everything at once – can be overwhelming both operationally and financially. A viable alternative for budgeting for ERP and CRM is a phased implementation strategy. This approach involves breaking down the project into smaller, manageable stages, deploying specific modules or functionalities over a period, rather than simultaneously. This method allows organizations to spread out the financial burden over multiple fiscal years, making it more digestible and less impactful on annual budgets.

The financial benefits of a phased approach extend beyond just cash flow management. It allows for incremental learning and adaptation. Lessons learned from earlier phases can inform and optimize subsequent stages, potentially reducing errors and associated re-work costs. It also enables quicker realization of benefits from early deployed modules, providing an earlier ROI that can help fund later stages. While a phased approach might extend the overall project timeline, it can significantly mitigate financial risk by allowing for more accurate budgeting for smaller, self-contained components. It also provides opportunities to pause, evaluate, and adjust the strategy based on early outcomes, ensuring resources are continually aligned with evolving business priorities.

Vendor Selection: A Direct Impact on Your Budget

The choice of ERP and CRM vendor has a profound and direct impact on your overall budgeting for ERP and CRM. Different vendors offer varying pricing models, product functionalities, service levels, and ecosystem costs (e.g., for third-party integrations or specific consultants). A thorough vendor selection process isn’t just about feature comparison; it’s a critical financial exercise that requires deep due diligence. Organizations must look beyond the initial sales pitch and demand comprehensive, transparent quotes that break down all potential costs over a projected 5-10 year period.

Consider not only the cost of the software itself but also the vendor’s typical implementation partner ecosystem (and their associated rates), ongoing support packages, potential for future upgrades, and any hidden fees. Some vendors may offer lower initial software costs but higher implementation or maintenance fees, while others might have a higher upfront price but a more predictable TCO. It’s also important to assess the vendor’s financial stability and long-term commitment to their product. A vendor who goes out of business or discontinues a product can lead to significant re-investment costs down the line. Leveraging RFPs (Request for Proposals) to solicit detailed financial breakdowns from multiple vendors, and engaging in robust negotiation, are crucial steps to ensure you secure the best value for your substantial investment.

The Budgeting Process: Steps to Financial Precision

Creating an accurate budgeting for ERP and CRM requires a structured, multi-step process. It’s not a single event but an iterative cycle of planning, estimating, reviewing, and refining. The first step involves defining clear project scope and objectives. What problems are you trying to solve? What functionalities are absolutely essential? A clear scope helps prevent uncontrolled “scope creep” which is a notorious budget killer. Next, conduct a thorough requirements gathering exercise, involving key stakeholders from all impacted departments. This will inform the selection of suitable software and identify necessary customizations or integrations.

Once requirements are clear, research and engage with potential vendors and implementation partners to obtain detailed quotes for software, services, and ongoing support. This is where the TCO analysis becomes paramount. Break down costs into distinct categories: software licenses, implementation services, hardware, data migration, training, internal staffing, maintenance, and contingency. Use historical data from similar projects if available, or industry benchmarks, to validate estimates. Regular review meetings with financial stakeholders and project sponsors are essential to track expenditures against the budget, identify variances, and make necessary adjustments. This iterative process ensures that financial planning remains dynamic and responsive throughout the project lifecycle.

Securing Executive Buy-in: Presenting the Financial Case

Successfully embarking on a major ERP or CRM initiative requires not just a solid budget, but also unequivocal executive buy-in. This isn’t merely about getting approval for funds; it’s about ensuring senior leadership understands the strategic value, financial implications, and potential ROI of the project. Your budgeting for ERP and CRM document should serve as a powerful tool to present a compelling financial case that resonates with decision-makers. Focus on demonstrating how the investment aligns with the organization’s overarching strategic goals, whether it’s increasing market share, improving operational efficiency, enhancing customer satisfaction, or reducing costs.

The presentation should clearly articulate the expected benefits, both tangible (quantifiable financial gains and cost savings) and intangible (improved decision-making, competitive advantage). Present a comprehensive TCO analysis, breaking down costs over several years and comparing different deployment models (e.g., on-premise vs. cloud) with their respective financial impacts. Highlight the risks involved and how the budget accounts for them through contingency planning. Speak their language: focus on profitability, efficiency, risk mitigation, and strategic advantage. A well-articulated financial narrative, backed by robust data and projections, is key to securing the necessary support and preventing financial roadblocks later in the project.

Post-Implementation Audit: Budget vs. Actual Analysis

The financial perspective on ERP and CRM doesn’t conclude once the system goes live. A crucial final step is the post-implementation audit, specifically a comprehensive budget vs. actual analysis. This involves meticulously comparing the initial budget allocations with the actual expenditures incurred throughout the project lifecycle. This exercise is invaluable for several reasons: it provides accountability, identifies areas of over or under-spending, and offers critical lessons learned for future technology investments. It’s a key feedback loop that strengthens an organization’s financial planning capabilities.

This audit should delve into every cost category, from software licenses and implementation services to data migration, training, and ongoing support. Investigate any significant variances: Did implementation take longer or require more resources than expected? Were there unforeseen customization needs? Was data migration more complex? Understanding the root causes of budget deviations is paramount. Beyond just costs, the audit should also assess if the projected financial benefits and ROI are being realized. Are the anticipated cost savings materializing? Has revenue increased as projected? This continuous financial review ensures that the substantial investment in ERP and CRM systems is truly delivering its promised value and helps refine future budgeting for ERP and CRM strategies.

Scaling and Future-Proofing: Long-Term Budgeting Considerations

Organizations rarely implement ERP and CRM systems with a short-term view. These are foundational technologies intended to support business growth and evolution for years, if not decades. Therefore, effective budgeting for ERP and CRM must incorporate long-term considerations for scaling and future-proofing the investment. As your business grows, your system needs to scale to handle increased user loads, transaction volumes, and data storage requirements. This might necessitate upgrading server capacity (for on-premise), increasing subscription tiers (for cloud), or adding new modules and functionalities. These future scaling needs should be anticipated and factored into multi-year financial forecasts.

Furthermore, the technology landscape is constantly evolving. Future-proofing involves budgeting for periodic major upgrades or even potential re-implementations as older systems become obsolete or fail to meet emerging business needs. This also includes budgeting for integrating new technologies like AI, machine learning, or advanced analytics tools as they become relevant. Continuous training for employees on new features or modules, and ongoing optimization efforts to ensure the system remains aligned with evolving business processes, also require financial allocation. A truly strategic financial perspective considers not just the immediate costs but also the perpetual investment required to keep these critical systems robust, relevant, and supportive of the organization’s long-term strategic vision.

Leveraging Financial Analytics for Budget Control

In the complex landscape of budgeting for ERP and CRM, leveraging financial analytics tools and techniques is no longer a luxury but a necessity for robust budget control. Modern financial management systems, often including components within ERP itself, can provide real-time insights into project expenditures, forecast variances, and track spending against allocated budgets. This allows project managers and financial controllers to move beyond static spreadsheets and engage in dynamic, data-driven budget management. Implementing powerful dashboards and reporting tools can highlight potential overruns early, enabling proactive corrective actions rather than reactive damage control.

By integrating project financial data with broader organizational financial systems, businesses can gain a holistic view of the investment’s impact on cash flow, profitability, and departmental spending. This includes tracking consultant hours against burn rates, monitoring software subscription renewals, and analyzing the cost-effectiveness of various implementation phases. Leveraging predictive analytics can even help forecast future costs based on historical data and project progress, improving the accuracy of long-term budgeting for ERP and CRM. These analytical capabilities transform budget management from a compliance exercise into a strategic tool for optimizing resource allocation and maximizing the financial efficiency of the entire technology investment.

Common Budgeting Pitfalls to Avoid in ERP and CRM Projects

While the promise of streamlined operations and enhanced customer engagement through ERP and CRM systems is compelling, many organizations fall prey to common budgeting pitfalls that can turn a strategic investment into a financial headache. Recognizing these traps is the first step in successful budgeting for ERP and CRM. One prevalent mistake is underestimating the true cost of implementation, focusing narrowly on software licenses while neglecting significant expenses like data migration, training, customization, and internal resource allocation. This often stems from a lack of detailed pre-planning and an overly optimistic view of project complexity.

Another pitfall is inadequate contingency planning. Projects of this scale inevitably encounter unforeseen challenges, and failing to set aside a significant buffer (e.g., 15-25% of the total budget) means any unexpected issue can trigger immediate budget overruns. Scope creep, where new requirements are added throughout the project without adjusting the budget or timeline, is another major culprit. Poor change management and insufficient user training can lead to low adoption rates, effectively wasting a substantial portion of the investment. Lastly, neglecting long-term maintenance, support, and upgrade costs in the initial budget often leads to unexpected recurring expenses years down the line. Avoiding these common errors requires meticulous planning, a realistic assessment of project scope, and a robust financial governance framework throughout the entire lifecycle of the ERP and CRM investment.

Conclusion: A Holistic Financial Approach to ERP and CRM Success

Successfully implementing and deriving value from ERP and CRM systems is as much a financial undertaking as it is a technological one. As we’ve explored, budgeting for ERP and CRM: a financial perspective demands a comprehensive, forward-looking approach that transcends the mere cost of software. From understanding the nuances of initial licensing and the vast landscape of implementation expenses, to meticulously planning for data migration, user training, customization, and ongoing maintenance, every financial element must be carefully considered. It’s about grasping the Total Cost of Ownership (TCO) in its entirety, preparing for contingencies, and understanding that internal resource allocation is as critical as external vendor fees.

Ultimately, the financial success of your ERP and CRM investment hinges on a strategic blend of meticulous planning, transparent communication with stakeholders, rigorous cost control, and a clear vision for measuring Return on Investment. It’s an ongoing journey that requires continuous financial oversight, from securing executive buy-in to post-implementation audits and long-term future-proofing. By adopting this holistic financial perspective, organizations can navigate the complexities of these transformative projects, ensure fiscal responsibility, and unlock the true, sustainable value that modern ERP and CRM systems are designed to deliver, paving the way for enhanced efficiency, improved customer relationships, and sustained business growth.